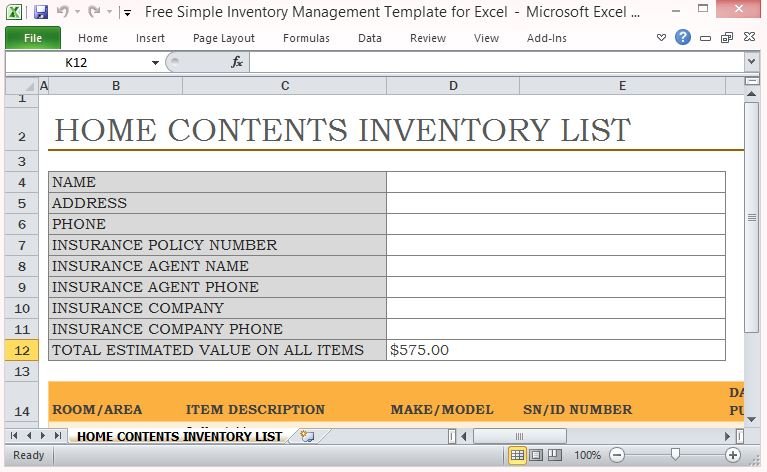

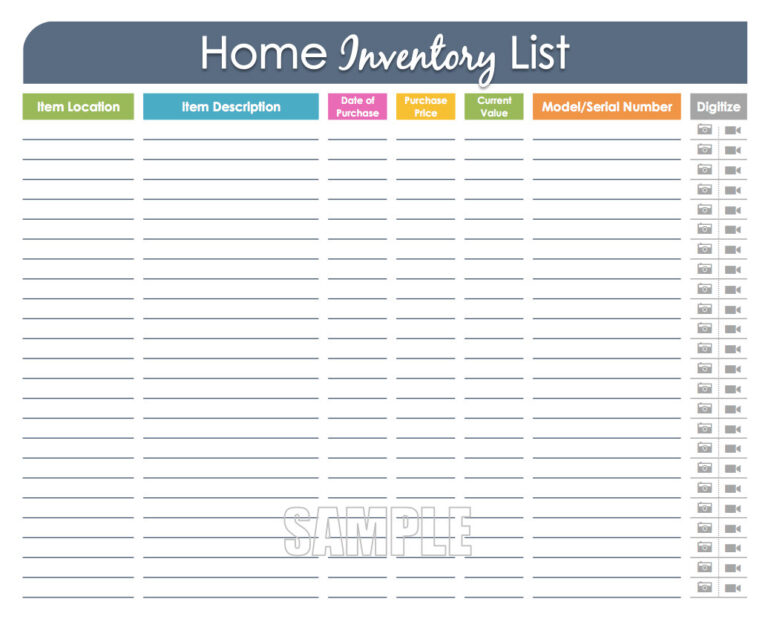

Without a record of your belongings, remembering what you've lost can be a challenge anytime, let alone during a time of trauma. After a fire, wind storm, robbery or other unexpected event, having a list or a visual reminder of your belongings can make a big difference in how much your homeowners insurance will pay, and thus how well you'll recover financially. You need to assess the worth of your personal belongings to get enough coverage and payout in case of any damage or loss.

What's more? You better prepare yourself for an emergency. Why You Need a Home Inventory Checklist If you want to buy renters insurance, you’ll get asked about personal property coverage which will define the final rate. With the space those discards leave, you may be able to better rearrange what's left. Get more tips on disaster mitigation and how to. You may identify items you can throw out. An accurate home inventory gives your insurance carrier the information they need to help settle your claims. A home inventory is a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss. The NAIC Home Inventory App features the ability to: group. The NAIC Home Inventory App makes it easy for consumers to create and protect a record of their belongings and offers tips on disaster preparation and filing claims. For one, you may find things you thought were missing. The National Association of Insurance Commissioners (NAIC) today announced the launch of its Home Inventory App. The process only takes a few hours, but it has long-lasting benefits. If your New Year's resolutions include getting organized, consider doing a home inventory.

0 kommentar(er)

0 kommentar(er)